This article teaches you to save and invest in a disciplined way by defining major investment goals in one’s life.

The Pattern of Our Behaviour

Imagine this: You have planned to accomplish many important things in your life – buying a house, an early retirement, good education for your kids – the list is long. And you have been saving regularly – when you get a bonus, when you get some large cash gift, or whenever you get a chance – and have been hoping that these savings would grow enough to enable you achieve the things you have planned.

And then, you see an advertisement promising a discount on that LCD TV you had been dying to buy. So, you go ahead and liquidate some of your investments to generate cash for the TV, and promise yourself to invest more to make up for this. You get the LCD TV you always wanted, but your investments suffer an out-of-turn reduction.

Impact on Your Investments

Sounds familiar? Replace the LCD TV with a vacation, a car or a laptop, and it could be anyone of us. Haven’t most of us sold some of our investments at some point in time to buy something unplanned? That is the problem with haphazard or random investment – like many other things in life – When you don’t have goals or targets, it’s easy to digress.

This means that a more disciplined, planned approach to investment is needed. You should know what exactly you are saving for, so that if you decide to sell some of your assets, it is easier to find out the direct implication on that target. You can also track the investments against your targets, so that you know precisely where you stand.

This is where Goal Based Investment comes in handy. It makes the task of investment very, very easy – the only thing needed is the discipline to invest regularly. Let me explain it in detail.

Steps in Goal Based Investing

Goal Based Investment means saving for specific goals. Following are the steps to be followed (Don’t worry – I would explain each step in detail):

- Think of major events in your life which would have a significant

financial implication, and for which you would like to save. - Find out the cost of achieving these goals today.

- Determine how far away these goals are from today (in years).

- Determine the cost of achieving these goals at the target time using an

approximate but conservative rate of inflation. - Determine the after-tax rate of return you can achieve when you invest today.

- Arrive at the per-year and per-month investment necessary for each goal,

if needed. - Start investing today, specifically for these goals!

This can be best explained using an example. So let’s say you are a 27 year old working woman, falling in the highest tax bracket.

Note: In the example, I have used Indian Rupees as the currency. If you are from a country other than India, just replace the currency and amounts with those relevant for you, and that would work – the basic principles of Goal Based Investing remain universally true for everyone!

{filelink=26} Download the worksheet for this example

Step 1: Determine Goals

Although there would be many financially significant events for which you would like to save, for this example, let’s say you decide you have only two goals.

| Sr. No. | Goal |

| 1 | Buy an apartment |

| 2 | Buy a car |

Step 2: Determine Current Cost

How much do these goals cost today?

In the area where you intend to purchase your 2 bedroom apartment, it costs around Rs. 30,00,000 today. The car you are planning to buy costs around Rs. 5,00,000 today.

| Sr. No. | Goal | Cost Now |

| 1 | Buy an apartment | 30,00,000 |

| 2 | Buy a car | 5,00,000 |

Step 3: Determine time frame

Now is the time to decide when you want to achieve these goals.

You decide that you would like to stay in your own apartment when you are 50. This means that you have 23 years to achieve that goal. You would like to buy the car in about 4 years from now.

| Sr. No. | Goal | Cost Now | Years From Now |

| 1 | Buy an apartment | 30,00,000 | 23 |

| 2 | Buy a car | 5,00,000 | 4 |

Step 4: Determine the cost of achieving the goals then

Now, this is a tricky part, because you would need to assume a rate of inflation. You would need to increase the cost of your goals using the inflation rate, because the cost of achieving your goals would keep increasing every year due to inflation.

Assuming the rate of inflation is difficult, because you would need to define it for the life of your goals – 23 years for goal 1 – which is a very long time!

You know that the current rate of inflation is around 3.25%. But you also know that this is around the historic lows, which means that it may not remain 3.25% for the entire 23-year period you are considering.

Since the average inflation for the past few years has been around 5%, you assume that the inflation would average 5% during this 23-year period too.

Since the purchase of car is just 4 years away, you assume a rate of inflation which is closer to the current inflation rate. Also, you don’t expect the cost of cars to rise too much due to the increasing competition. So, the rate of inflation for this goal would be 3.25%.

Having decided the rate of inflation, you now need to find out the cost of achieving your goals at their target dates. For this, you need to use the compound interest rate equation:

Amount = Principal * [{1 + ( Rate / 100 ) } ^ Years ]

For us,

Principal = Cost today

Rate = Assumed rate of inflation

Years = Years till the achievement of the goals

Using this formula, we arrive at the following figures:

| Sr. No. | Goal | Cost Now | Years From Now | Cost Then |

| 1 | Buy an apartment | 30,00,000 | 23 | 9214571 |

| 2 | Buy a car | 5,00,000 | 4 | 568238 |

I am sure this would prove to be an eye-opener, as you realize how inflation wrecks havoc on your targets, especially the long-term ones!

That’s why I believe that compounding can be the most powerful friend when used wisely in the form of starting investments at a young age, but at the same time, can be the most devastating enemy in the form of inflation for long-term goals.

Step 5: Determine the after-tax rate of return for investments made today

This is another assumption you need to make – how much your investments would return if you invest today? Also, it is important to assume an after-tax rate of return, because that is what you get in your hands

for spending!

The rate of return would depend largely on the type of investment.

Since the goal of buying an apartment is 23 years away, you can very safely invest in stocks, as stocks give the best rate of return in the long term. Historically, stocks have returned 15% – 20% returns over the long term, so you assume that you would be able to achieve around 18%. Since there is no long term capital gains tax on stocks, your post-tax return would also be 18%.

The goal of buying a car is only 4 years away. This is a very short time to invest in stocks for a goal – short term volatility in the stock markets could eat into your returns, and you may not be able to get enough to buy a car. So, you decide to invest in bank FDs which give around 9.5% per year. Since you fall in the top tax bracket, and pay 30% tax, your post tax return from the FDs would be:

9.5% – (30% of 9.5%) = 6.65%

| Sr. No. | Goal | Cost Now | Years From Now | Cost Then | Rate of Return |

| 1 | Buy an apartment | 30,00,000 | 23 | 9214571 | 18% |

| 2 | Buy a car | 5,00,000 | 4 | 568238 | 6.65% |

Step 6: Determine the per-year and per-month investments needed

Using the figures that we have till now, you can calculate the lump-sum amount that you can invest now to save enough for your goals. For this, you need to discount the “Cost Then” using the “Rate of Return”. In

simple terms, it means:

How much money you need today, so that it would grow into an amount equal to “Cost Then”, if invested at a rate equal to “Rate of Return”.

The formula for this is a variation of the compound interest formula:

Principal = Amount / [{1 + ( Rate / 100 ) } ^ Years ]

For us,

Principal = Lump-sum amount to be invested now

Amount = Cost of achieving the goal at the target time

Rate = Assumed rate of return

Years = Years till the achievement of the goals

For our goals, we arrive at the following figures:

| Sr. No. | Goal | Cost Now | Years From Now | Cost Then | Rate of Return | Amt Needed Now |

| 1 | Buy an apartment | 30,00,000 | 23 | 9214571 | 18% | 204734 |

| 2 | Buy a car | 5,00,000 | 4 | 568238 | 6.65% | 439225 |

Shocked by the amount needed to be invested now, for the goal of buying an apartment? But it is true – and this is the power of compounding. Since you are making a very long term investment, compounding would do most of the hard-work for you!

Also note that the “Amount needed now” is less than the cost of the goals today, because the assumed rate of return is higher than the assumed inflation rate. Since for goal 1, the difference is very high, the amount needed now is significantly lower than the cost of the goal today. For goal 2, the difference is less, and so the amount needed now is only slightly lower than the cost of the goal today.

The “Amount Needed Now” figure gives you the lump-sum amount that you can invest now to save enough for your goals. This would be possible if you have a one-time surplus – like a yearly bonus. If you have such a surplus, go ahead and invest it – and you won’t need to invest every year or every month for the goal. But please be careful – I would suggest that even if you do have the amount needed, if you are investing in the stock market, make staggered investments so that you can benefit from cost averaging.

But most people would not have such a large amount at their disposal, and for them, the best way is to invest periodically. So, lets go ahead and find out how much you need to invest every year for each goal.

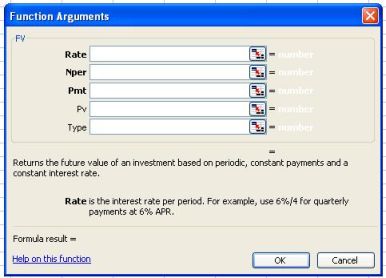

For doing this, we would use the concept of an Annuity, and we would do it using a function called FV (Future Value) in MS Excel. It looks something like this:

{filelink=26} Download the worksheet for this example

The FV formula gives the future value of a periodic investment, if we know the rate of return, the periodic investment, and number of periods (years).

Here is a little twist – we already know the answer for this formula, and that is the cost of achieving the goal at target time. What we don’t know is the “periodic investment”, which we need to find out.

So, in MS Excel, insert this formula, and adjust the value of the cell “periodic investment” such that the result of the formula is equal to the cost of achieving the goal at target time. This is the yearly investment needed to earn enough to achieve your goal in time! For simplicity, just divide this amount by 12 to get the monthly amount.

| No. | Goal | Cost Now | Years From Now | Cost Then | Rate of Return | Amt Needed Now | Amt Needed Per Year | Amt Needed Per Month |

| 1 | Buy an apartment | 30,00,000 | 23 | 9214571 | 18% | 204734 | 37690 | 3141 |

| 2 | Buy a car | 5,00,000 | 4 | 568238 | 6.65% | 439225 | 128650 | 10721 |

Step 7: Start Investing

Now that you know exactly how much you need to save each month for each of your goals, what are you waiting for? Go ahead and start investing!!

You can make the monthly investment needed through a mutual fund Systematic Investment Plan (SIP). If you have multiple goals, as you would in real life, you may combine the monthly investment needed for 2-3

goals and invest them together in a good MF SIP.

Happy investing!

Illustration:

Here is a table indicating the yearly and monthly savings needed if the goal of buying the house is 5, 10, 15, 20, 25 and 30 years away. Again, we assume the rate of inflation to be 5%.

| Sr. No. | Cost Now | Years From Now | Cost Then | Rate of Return | Amt Needed Now | Amt Needed Per Year | Amt Needed Per Month |

| 1 | 3000000 | 5 | 3828845 | 18 | 1673623 | 535188 | 44599 |

| 2 | 3000000 | 10 | 4886684 | 18 | 933672 | 207756 | 17313 |

| 3 | 3000000 | 15 | 6236785 | 18 | 520872 | 102301 | 8525 |

| 4 | 3000000 | 20 | 7959893 | 18 | 290581 | 54286 | 4524 |

| 5 | 3000000 | 25 | 10159065 | 18 | 162108 | 29653 | 2471 |

| 6 | 3000000 | 30 | 12965827 | 18 | 90436 | 16393 | 1366 |

If the goal is 30 years away, you need to set aside a very modest sum of Rs. 16,393 per year. But if the goal is 10 years away, you have to set aside a hefty sum of Rs. 2,07,756 every year.

This example illustrates that the earlier you start saving, the better is the effect of compounding, and therefore, the lesser is the money that you need to invest. Time has a disproportionate positive effect on

your returns.

Note:

The calculations that you would do depend on two very important assumptions:

- Expected rate of inflation

- Expected rate of return

Please note that both these need to be assumed as accurately as possible, as even a little change in these can vastly impact the amount needed to be invested every month, especially for long term goals.