The thought of buying a new house without enough funds will make you think of the only possible option - “Home Loan” or “Mortgage Loan”.However, before reaching a bank, a home loan broker or other lender for a home loan, you should know a few things. Affordable Amount Before going … [Read more...]

Debt Collection or Debt Recovery – Where are We headed?

We take loans for almost everything - a house, a car, a computer or laptop, an LCD TV, a foreign vacation, and a lot more.We have every intention of repaying that loan, but there are times when we just can't - due to things like loss of income or unexpected expenses, there are times when we stop … [Read more...]

No More Penalty on Prepayment of Home Loan

A penalty charged by banks while you prepaid your home loan has always been a sore point for home loan takers.Now, the Reserve Bank of India (RBI) has abolished this prepayment penalty.Read on for full details. The Prepayment Penalty for Home Loans A home loan is the biggest loan … [Read more...]

Buying a home becomes more difficult – Now you get lesser amount as home loan

If you are a middle class, salaried individual, buying a house or flat of your own has become really difficult. The main reasons are the high property prices, and the high interest rates for home loans.But now, there is another factor that is going to make home purchase even more difficult for … [Read more...]

Education Loans / Study Loans / Student Loans in India

The cost of higher education has been escalating day by day, and it is increasingly becoming difficult to fund higher education expenses yourself.If you have been looking for funding your own higher education, or the education of your son or daughter, an education loan (also called a student … [Read more...]

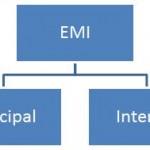

Understanding Equated Monthly Installment – What is an EMI?

We all keep hearing about EMI, and most of us also pay EMIs for various loans. But what exactly is an EMI? What is its breakup? If you have to prepay a loan, whan should you do it? Let's understand. … [Read more...]

All about “teaser rate” home loans – And what its end means for you

Some of the large banks in India have announced that they are stopping the “teaser” rates for home loans. Is this good for you, or bad? How does this effect you? Find out! … [Read more...]

Migrating to the “base rate” regime from BPLR – the impact on you and what you should do

Banks have moved to the “base rate” system from the “benchmark prime lending rate (BPLR)” system. What does it mean? How does it affect you? Read on. … [Read more...]

Transparency in floating interest rate home loans – Customers to know changes in reference rate instantly

The Banking Codes and Standards Board of India (BCSBI) has asked its member banks to publish the reference rate to which its floating rate loans are tied. The banks have also been asked to publish any changes made to the reference rate. … [Read more...]

Income Tax (IT) benefit of an education / study loan – Section 80E

This article explains how you can save income tax under section 80E if you have availed of an education / study loan. It also tells you the nitty gritties: what is the process, how much you can save, who can benefit from this, etc.[This article has been inspired by queries from readers Ravi … [Read more...]